Audita blog - 1 NOV 2024

Future of MEV Bots: MEV-Share and SUAVE

MEV has been shaping the crypto ecosystem as we know it, lurking in the background and capturing every opportunity. In our previous article, we looked at the MEV ecosystem, following its past and reaching to its present state.

Now it's time to look at the most recent developments in MEV - what the people behind Flashbots have been working on to improve MEV and mitigate the risks involved.

What are MEV Bots?

To remind ourselves of the nature of MEV - MEV stands for Maximum Extractable Value. MEV Bots are essentially programs designed to detect any price discrepancies and opportunities to extract value from a liquidity pool, a trade, or to manipulate transaction ordering in the blockchain to maximize profit.

These bots operate by monitoring the mempool for pending transactions, allowing them to execute strategies such as arbitrage, front-running, back-running, sandwich attacks and more.

What is MEV-Share

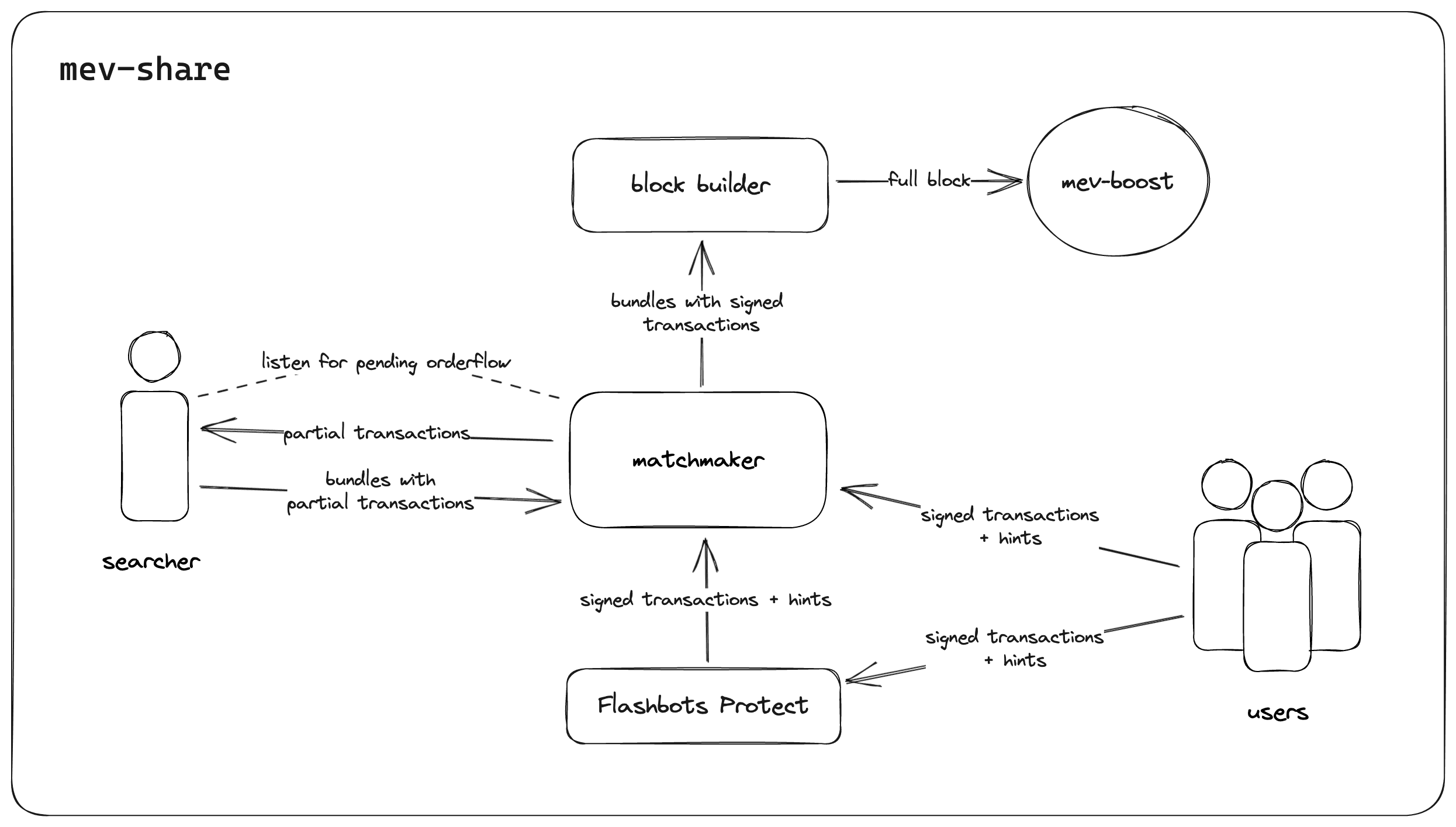

MEV-Share is essentially a match-maker.

Rather than allowing MEV profits to concentrate among a few sophisticated actors, MEV-Share creates a more fair system by letting users to share the value extracted from their transactions.

The protocol works by allowing users to submit their transactions to a specialized network where validators can identify and capture MEV opportunities, with the resulting profits being distributed between the validator, the transaction sender, and other network participants. This approach makes MEV extraction more transparent and helps reduce negative externalities like network congestion and gas price manipulation that traditional MEV extraction can cause.

Source: Flashbots.net

In order to benefit automatically from MEV-Share, users must send transactions through Flashbots Protect.

What is SUAVE?

SUAVE stands for the Single Unifying Auction for Value Expression.

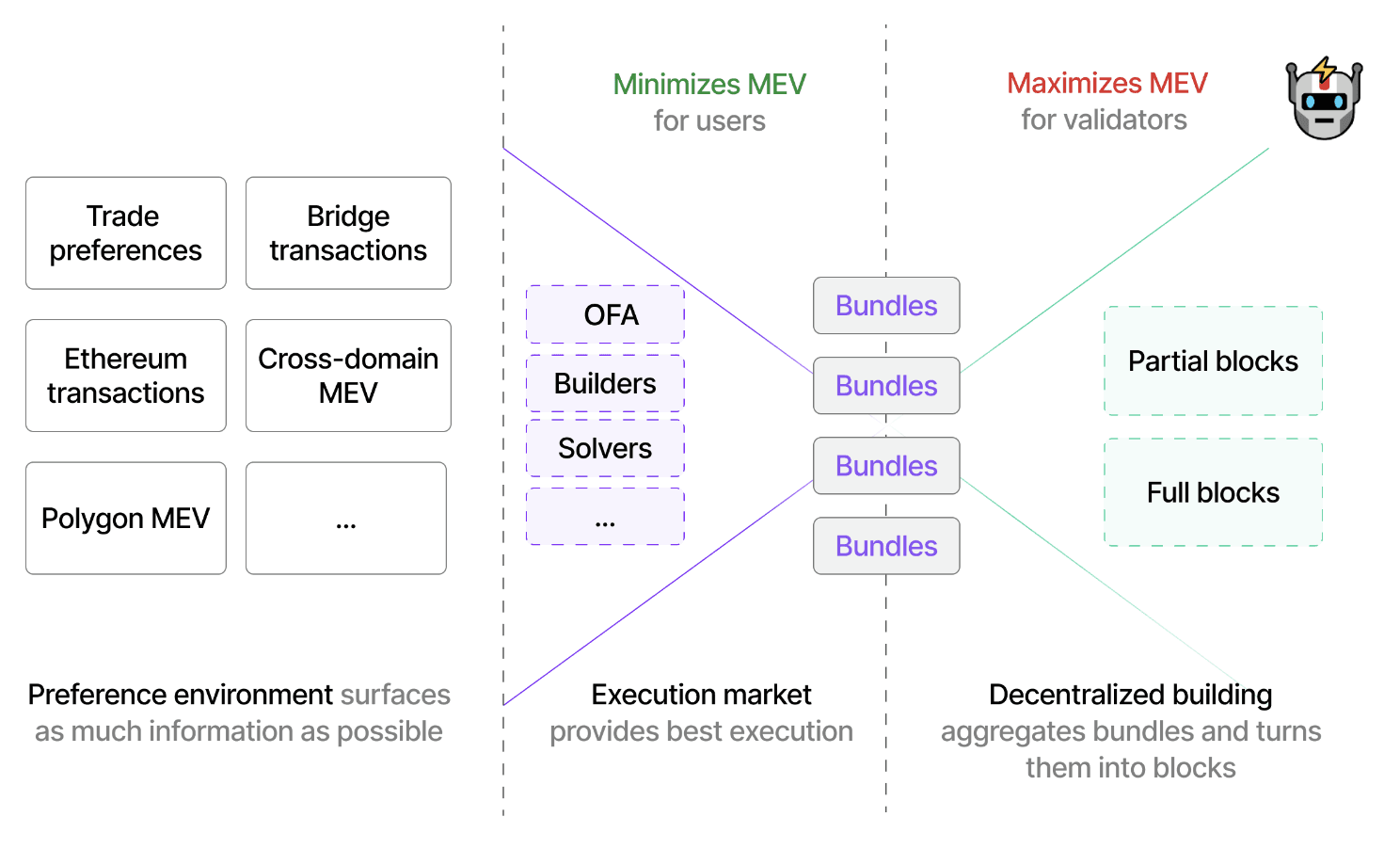

It aims to decentralize block building itself. MEV-Share functions as a centralized hub that collects and organizes trading intentions from both users and searchers across multiple blockchains, using a specialized blockchain and transaction pool designed specifically for expressing and finalizing these preferences.

It will strive to be an Optimal Execution Market - Executors will listen for SUAVE mempool transactions and compete to provide the best execution according to user preferences.

A decentralized network of block builders is designed, so that encrypted preferences from users can be accessed and merged into partial or full blocks.

Source: Flashbots.net

MEV and Decentralization

These solutions push us to test and see what meaningful decentralization looks like in the context of MEV.

Despite our industry still being small, we know enough to have reached the conclusion that on paper decentralization and faux markets do not make the cut.

While MEV-Share aims to democratize value extraction by creating a more inclusive and transparent system for sharing MEV profits, SUAVE takes a broader approach by providing a decentralized compute environment for MEV activities. Together, these protocols signal a shift away from the current paradigm where MEV benefits are concentrated among a select few.

We're anticipating the developments in the coming years - our team at Audita is working around the clock to safeguard blockchain protocols. Our expertise in identifying potential exploits will be essential for projects implementing MEV-related functionalities, ensuring that these new mechanisms don't introduce security risks.

Reach out to us via our contact form.

Building a safer Web3 together, one audited protocol at a time.

STAY SAFU

Audita's Team